4 Don’ts When Promoting Trading Offers with Push Notifications

There’s hardly a more attractive vertical than Forex, even though the industry is under increased scrutiny of the EU and the U.S. authorities. But does it scare away potential affiliates?

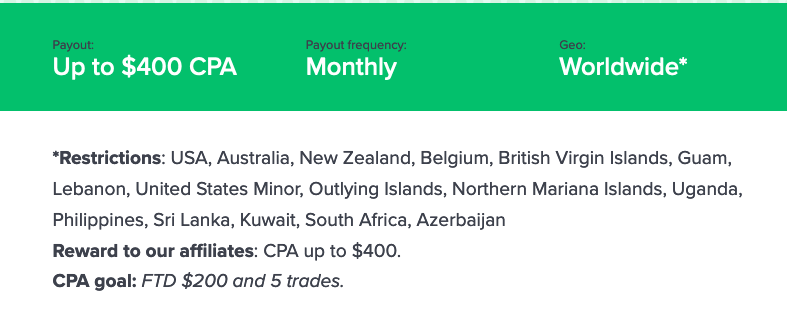

Not even near! Forex companies are struggling to survive, find new markets and fresh sources of income, so big money is at stake. You can’t surprise anyone with gargantuan payouts, reaching $150-$400.

From our side, we see a solid growth: volumes are up more than 30% compared to 2017. Apart from the reasons we’ve already mentioned, there’s one more reason why volumes were increasing – Push Notification ads.

To cut the chase, let’s sum up why affiliates are so excited about our Push traffic:

- it’s direct – you can reach customers even when they are not browsing;

- it’s fast – volatility, sudden market move – you can let the audience know in only a few minutes;

- it’s flexible – there are gazillion targeting settings for you to fine-tune your campaigns and combine with other ad formats if you need to;

- it’s massive – our user base is now over 230 million (and keep growing).

Sounds cool? Indeed, so today, we decided to conduct an experiment of sorts and list the things you shouldn’t do when running forex campaigns with Push Notifications.

Don’t #1. Don’t leave the same creatives for more than a week

There’s a major rule for Push campaigns – change the creatives regularly. It’s not just that they burn out super-fast and people get bored to see the same banners and messages; it’s also about stiff competition.

If your competitors’ creatives have higher CTR than yours, they will grab the best traffic (and the best leads). The moral of the story? Don’t make it so easy for your rivals – refresh the creatives and test new ideas. By the way, here’s a great testing tool.

Don’t #2. Don’t target newbies (only)

When running trading campaigns, it’s extremely tempting to go for an easy workaround and create a standard Push, targeting people, who are looking for fast money, aka newbies.

Here’s a standard example:

Not bad, but you can do better!

Targeting experienced traders can bring you more money.

And here’s why: from July 2018, European Securities and Markets Authority (ESMA) introduced the changes regarding the client status – only “professional” traders can now get the highest leverage. And guess what? Brokers prefer seasoned traders (in the majority of the cases) because serious traders trade serious money.

If you are working on Revshare basis, experienced traders are even better for your wallet – they won’t quit once they lose their first deposit, and you’ll continue to get profits.

So how do you catch experienced traders? Include the following stuff in your Push Notifications:

- Charts, technical analysis, etc. These visuals make the trader’s heart beat faster. For example (this “flash crash” looks pretty impressive):

- Use the trading calendar for event-targeting campaigns. For example: “Volatility alert! FOMC meeting is tomorrow. Trade now.” You can find charts and inspiration for market news on Forex Factory, Seeking Alpha, Investing.com.

- Do mention that the broker is licensed. Most of the serious traders won’t deal with unregulated brokers, because a license means certain guarantees and security. So simply adding words like “CySEC” or “FCA” will boost the trust in an instance.

- Talk about conditions: withdrawals, spreads, fees, min. deposit – all these criteria are essential for pros.

Don’t #3. Don’t mix multiple GEOs in one campaign

Although you might see in an offer description that countries are grouped into lists by the payout amount – don’t fall for this trick – don’t include multiple GEOs in one ad campaign.

Why should you never do that?

- You make it more difficult to optimize this campaign;

- It’s hard to adjust the bid because the traffic costs vary.

Here’s a real example. We’ve searched forex offers and found one, where Austria, Germany, and the UK were in the same group. Let’s check the recommended bids for these countries (Push Notifications, Targeting “All users,” CPC):

Austria $0.12

Germany $0.08

The UK $0.065

If you included these GEOs in one campaign, you would either overpay or wouldn’t get enough traffic in some countries. Imagine the long hours of optimization time!

Don’t #4. Don’t make the user journey too complex

Usually, Push traffic has a very high level of engagement, and the leads are “hot,” meaning if the user clicks on the notification – he’s definitely interested.

And that’s precisely why using misleading ads is not recommended – you are wasting your own money.

In other words, we have a person who’s potentially interested in trading. Do we need to add extra steps to the funnel? While it’s not an easy question to answer and it depends on the offer, here are some general key points:

- Don’t add pre-landers if the conversion flow is easy (if registration / demo = lead);

- Do add pre-landers with additional information on the security of funds and trading conditions if the conversion flow is complex and you need crème-de-la-crème leads (if deposit / traded lots = lead).

Now you know what mistakes to avoid when launching Push campaigns and what ideas to test. Promoting trading offers with Push Notifications can be extremely profitable if you set it up correctly and have high-converting traffic…but as for traffic part, you know where to find it!

Want to discuss this, right? Okay. Just share your thoughts in the comment section below or chat with fellow affiliates on our Telegram chat.