What is KYC and Why It Matters

PropellerAds is all about real people: whether it is bot-free traffic, real users, or authentic impressions.

Being one of the top traffic sources worldwide, we feel responsible for keeping our platform free from bots or fraud of any kind, fully transparent, and reliable. Taking into consideration all the latest financial safety trends, regulator’s requirements, and experience of the biggest companies, we came to an understanding that we could enhance the security of our community through the industry-standard KYC process – “Know your client.”

Being in the market for 10 years already, we have always been pioneers in adopting new trends (and safety ones as well) and constantly put an effort to comply with all the regulator’s requirements.

Although it’s still a comparatively new procedure for the affiliate industry, we know that PropellerAds users will appreciate the payoff because the outcomes are worth it – real people & real interactions. That’s why we all are here, right?

What is KYC, and is it THAT important?

In simple words, KYC or “Know your Client” is a process of verifying a user’s identity.

You may know that KYC is now a global trend that started to gain popularity outside the banking sphere. Why?

Because businesses want security. And we’re not talking solely about the financial component. KYC helps combat illegal transactions, think corruption, money laundering, terrorist financing.

Still believing it’s a lame excuse to get your data?

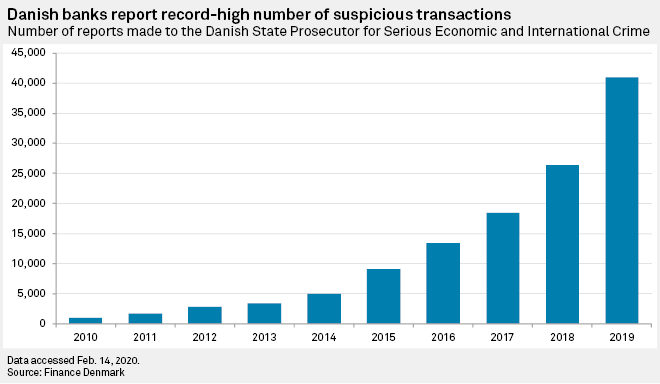

Have a look at these stats:

And that’s just in Denmark.

We, as a company, can’t ignore the situation and put our clients at risk.

In other words, KYC allows us to protect ourselves and all our clients by ensuring that we are doing business legally and with legitimate entities. Financial crime is not an option.

Why KYC is a good sign

KYC is generally an indication that the company is legit. If a business cares about its future (it should!), it will implement security procedures.

We all heard the stories when the company messed up with their KYC, and regulators seized clients’ funds. Examples? (*Rolls up the sleeves*)

- Westpac (December 2019) – 23 million alleged breaches of anti-money-laundering laws have plunged the bank into the Mariana trench-deep crisis.

- GFC Good Finance Company (May 2019) – this payment provider was also shut down over AML concerns.

- BTC-e (July 2017) – accused of money laundering. US authorities seized the BTC-e.com domain name and 38% of all customer funds.

The moral of the story? KYC = security and stability.

KYC in AdTech & Affiliate industries

Is it just Propeller who implements KYC? Of course not! Let’s see what other companies are now applying this security model:

Google’s advertiser identity verification

First, Google was focusing on verifying advertisers, who were launching political ads. Then, the company rolled out a verification program for all US advertisers. And, finally, starting this summer, they are going global.

Here’s what Google will require: “Advertisers will need to submit personal identification, business incorporation documents or other information that proves who they are and the country in which they operate.”

Facebook business verification

The social media giant is no different from Google. To verify your business page, you have to provide a whole pack of documents. Also, Facebook is performing KYC for anyone using Messenger’s payments feature.

Affiliate networks & Programs

The affiliate industry is moving towards greater security as well. As soon as networks and partner programs have to deal with payments (i.e., your payouts), they are obliged to request your data. Although many networks don’t openly talk about their security procedures, you can find multiple evidence that these checks indeed take place. Here are some examples from AffiliateFix discussions, GPWA, and many more – they are easy to google.

Trading & Crypto

These industries are extremely familiar with KYC, and you can’t surprise a forex trader with additional security procedures. Moreover, each year international authorities are tightening the regulations making the checks even more elaborate.

Hostings & CMS

A large number of hosting companies are implementing customer verification procedures, especially when the domain is first purchased. The major reasons for that are again fraud and financial crimes. Here are examples of companies: GoDaddy, Leaseweb, b2evolution.

Good to know: How are your documents processed?

Usually, the KYC process consists of 2 pivotal elements:

- Proof of Identity (a valid, government-issued identification)

- Proof of Address (for example, a recent utility bill or a bank statement)

*Please note that our KYC officer may require additional documents.

Important: Information you provide will be used for verification purposes only, and we guarantee your full privacy: your data will not be shared with anyone else. After a certain period of time (usually after the account is closed), we will automatically delete it. More about our KYC process

- As an EU company, all the data is processed with strict adherence to GDPR rules and the EU privacy laws (As well as KYC data)

- Usually, it takes no longer than 5-7 business days (from the moment the documents are received)

- For more information, we encourage you to read the privacy policy

TLTR: Key takeaways here

- KYC is a way to verify the identity of the client and is done to protect the clients’ funds and the business

- When it comes to money and payments, KYC is a must. You should be really worried if a company is not requesting your documents. Run away!

- Customer verification helps combat fraud and money-laundering and improves YOUR financial safety

- Finally, you can read more about our safety processes here

Let us know if you want more info about security protocols in the comment section below. Or let’s just talk affiliate marketing on our Telegram Chat.

Stay safe!