The Insurance Vertical Overview: How to Make Your Campaign Profitable?

This post is also available in:

PT

ES

The Insurance vertical is appealing, but pretty tricky at the first glance. Indeed, this niche has a high entry barrier. Insurance offers require serious investments at the start, but their main advantage is a stable and high profit ahead.

Your offers can bring you real cash if you know how to make them roll. And today, we are going to discuss some important questions as well as practical tips on how to make your campaign work. Let’s do it!

Insurance offers: what are they?

Insurance vertical is 100% legal, so most affiliates use social media as an advertising platform for this niche. Such ads easily pass moderation in case you don’t violate any rules of the chosen platform (we mean, forbidden content usage).

For other advertising spaces, you are welcome to use Push ads and In-Page Push ads formats. Affiliates usually work with the following types of offers:

- Car insurance

- Medicare (64+ years old)

- Life insurance

- House insurance

Working with the Insurance vertical, affiliates usually get paid for customer calls. Visitors use a dedicated line to order a service and the fee depends on several factors: the call itself, its length, result, etc.

Another payment model is a classical CPL – you get paid for the customers you actually bring. Now let’s see how a common Insurance offer looks like.

Offer peculiarities and targeting + example

Here are some general recommendations for your Insurance targeting:

- GEO: USA or Canada

- Format: Push and In-Page Push (with pre-landers only)

- Age: 35-55

- Device: Mobile

- Ad platform: social networks

- Payment model: CPL (cost per lead) or PPC (pay per call)

- Season: All year round, but especially – October and December

The last point needs some clarifications. Alexander Duzhnikov from Marketcall, an expert proficient in Insurance offers, shares the following information:

“Affiliates should consider a special thing about Insurance offers: open enrollment. In the USA, people buy insurance the whole year round, there is a hot season to advertise them – November and December. During these months, people can change their insurance plan without paying a fee.”

The most common flow for the insurance offers looks this way:

The ad leads to a landing page where users have two options: to make a call (PPC model) or complete a form (CPL model).

Some affiliates work with the Insurance vertical for a pretty long time and therefore – have a large customer base (as a rule, Americans purchase insurance once a year). Affiliates can communicate with such customers by means of chat bots or mailouts to get significant profit later on.

Which creatives work best?

Tailoring a really great creative for an Insurance offer is absolutely a must. All in all, buying a car or health Insurance is something more serious and significant than downloading utilities or participating in giveaways. You have to be inventive to convince your audience.

From our partner’s experience, the best approaches for car Insurance creatives are:

News

We took an example from the car insurance ad here. Any news that might interest car drivers will work great for your creatives: road safety, policies, license updates, car reviews, etc. These might be pictures of newscasters, video cuts and pictures, etc. Placing all of this to a pre-lander might be a really great idea.

This approach will attract the adult public and capture their attention, since they are used to focusing on such important things as news.

Here is an example:

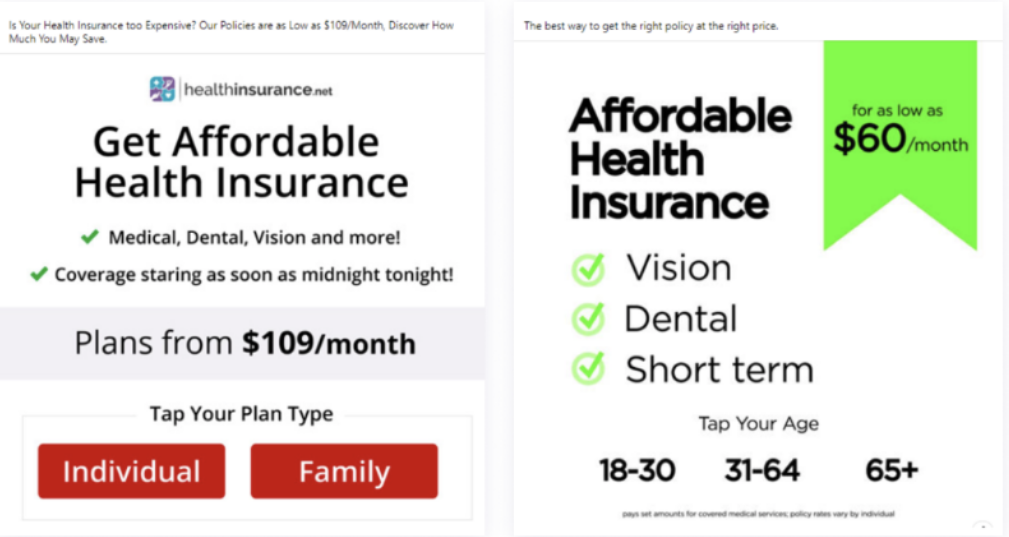

Appealing conditions and prices

Our partners from Marketcall shared their experience – creatives with beneficial prices bring conversions. The numbers work best when you combine them with the Insurance plan, like this:

This approach works great for Push and In-Page Push ads – you don’t have to include too much text there, but appealing prices will definitely catch users’ attention.

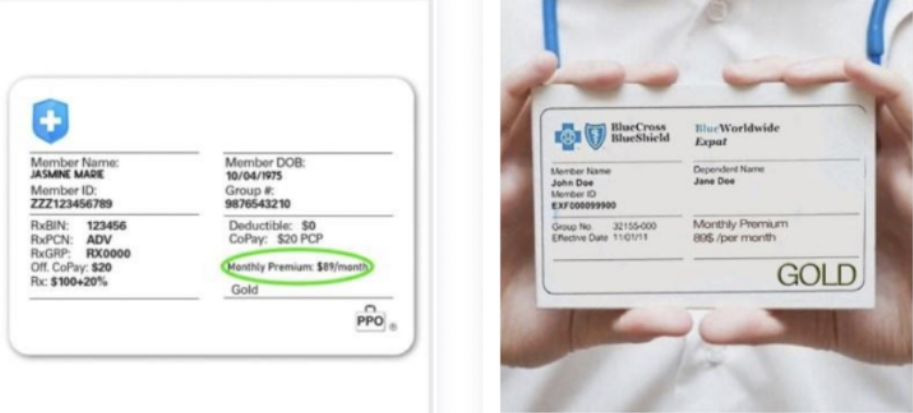

Insurance cards

Insurance cards also attract users’ attention, especially when you mark some areas with color to highlight the exclusivity of your offer. For instance:

Inform users about the Insurance conditions

In the Insurance vertical, explaining the offer is extremely important. Use a pre-lander to provide all the details, terms, and conditions. Don’t ignore this point, since a lack of information increases the risk of losing potential leads.

Insurance vertical requires especially extensive work with creatives. Be ready to fine tune and launch new creatives all the time. This vertical is pretty complicated, so whenever you find a banner that works today, it doesn’t mean that it will continue working tomorrow. Make sure to reconsider your ideas and experiment.

Also, there are themes and images you should avoid. For example, don’t use any personal ID pictures, car incidents, political figures, or pandemics for your banners.

And yes, prepare to spend some cash for your tests – the entry barrier is high and it is not easy to predict which creative will work properly for your campaign.

You will need a pretty large budget to skyrocket. Prepare to devote at least a month of your time and no less than $2000 for a successful start. However, with a smart approach, you will have a chance to earn more and your further income will be stable – this is one of the main peculiarities of the Insurance vertical.

Let’s sum up!

To conclude, we have a check-list for your future Insurance campaign:

- Choose the offer

As the Insurance vertical is not the most popular one, finding a really beneficial offer is not the easiest thing to do. Take a look at the best offers from Zeydoo right here:

- Experiment with creatives

Mind our recommendations about creatives and test different approaches to see which one works best for you. Also, take care of the textual part and add a detailed offer description to your pre-lander.

- Adjust targeting and timing

As we have discussed, the best GEOs for Insurance offers are the USA and Canada, while the most relevant age group is 35-55 (or 64+ if you work with Medicare offers).

By the way, don’t forget that PropellerAds Audiences feature can help you adjust your targeting and choose the audience by interests, age, and gender.

Social traffic works great for Insurance, while you should target mobile rather than desktop users. You can work with Insurance vertical the whole year round, but mind the hottest enrollment time period – November and December.

If you are looking for a sure and stable way to get money from affiliate marketing, Insurance vertical might be a great option for you. Approach your campaigns smartly and go get some dollars!

Join our Telegram chat to share your insights about the Insurance vertical or ask fellow-affiliates about their experience!