PropellerAds TMA Report: The State of Telegram Mini App Advertising in 2025

2025 has been a turbulent year for the Telegram Mini App (TMA) ads market so far. The сhannel has quickly become one of the most promising traffic sources. However, its rapid growth was then followed by restrictions, new rules, and the first signs that the ecosystem is becoming more regulated.

Despite the challenges, the channel continues to expand. The Telegram Ads market has reached approximately $10B, and advertiser interest remains strong. In this PropellerAds report, we break down how the Telegram Mini App advertising market changed in 2025, which formats, GEOs, and verticals can be called the most promising, and what to expect in 2026.

In this report, we have compiled the latest data, key statistics, insights, and predictions to help media buyers and advertisers navigate the next stage of TMA.

Telegram and TMA Digest: What Happened In 2025?

On the one hand, Telegram’s overall audience has expanded, growing from 900M to 1B monthly active users between March 2024 and March 2025. About half of them interact with Mini Apps, ranging from lightweight games to handy tools, and TMA has become a trendy ad landscape that has attracted numerous advertisers.

At the same time, the Telegram market as a whole, and specifically the TMA niche, has experienced several significant setbacks that have reshaped the ecosystem. Here is a brief digest of the key TMA events in 2025.

Telegram Became a Global Performance Channel

Telegram’s traffic in 2025 has evolved far beyond just a few GEOs, often accompanied by caveats such as fake channel metrics, bot activity, and artificially inflated channel groups. The platform now hosts a diverse global audience, including a rapidly growing Asian segment that often flies under the radar.

As a simple messenger in its early stages, Telegram has rapidly gained traction in performance marketing and affiliate spaces, particularly at conferences, where it has become the default contact method. In many cases, a Telegram link has fully replaced business cards, and this drives a steady stream of high-quality, engaged users.

In many ways, Telegram has become the new Facebook as a user acquisition channel: every serious business, media outlet, or affiliate brand now considers a Telegram channel or chat a must-have. For many, it has also become a core monetization tool, not just a community hub.

Forced TON Migration

In 2025, Telegram required all crypto Mini Apps to migrate to TON, Telegram’s own blockchain, built directly into the messenger. In simple terms, TON is the native cryptocurrency layer within Telegram; it powers wallets, payments, and smart contracts without requiring users to access external apps.

While there was no official ban on other chains, the shift was obvious in practice: Telegram began restricting apps built on Ethereum, BNB Chain, Polygon, and other networks. Developers repeatedly complained that their apps were disappearing from search or losing functionality. The only reliable way to restore visibility was to migrate to TON, integrate TON Connect, and rebuild the backend around TON smart contracts.

As a result, the crypto TMA vertical became smaller but more solid: fewer low-effort projects, and more TON-native apps that work faster and safer inside Telegram.

iGaming Mini-Apps Bans

In 2025, Telegram began actively removing iGaming-related Mini Apps. The most notable case was a big iGaming brand, which was taken down due to concerns about unregulated activity and onboarding. Although Telegram did not announce a formal global ban, many similar TMAs were quietly restricted.

This made a certain impact on iGaming advertisers and affiliates, but didn’t lead to the death of the vertical, though. The more positive verdict of the shift is that it marks Telegram’s move toward stricter compliance and safer standards.

New Moderation Policies for Mini Apps

In 2025, the TMA ecosystem saw the rise of unofficial legal and compliance checklists created not by Telegram but by law firms, Web3 consultants, and developer communities. These guides appeared because many Mini Apps were being restricted or removed, while Telegram’s own documentation remained minimal and has not significantly changed.

In response, legal teams began releasing checklists that interpret Telegram’s terms of service (ToS), TON guidelines, and actual moderation cases. These checklists cover topics such as privacy policies, payment transparency, licensing for sensitive sectors, and other recommended practices.

These documents are not official Telegram policy, but they have effectively become a practical reference for Mini-App developers who want to avoid hidden bans.

Regional Telegram Bans

Several countries introduced new restrictions on Telegram in 2025, which created GEO-level traffic drops. These platform-wide bans obviously affected Mini Apps, too. Here are the countries that confirmed Telegram blocks:

- Vietnam – nationwide Telegram block due to fraud and ‘harmful content’ concerns

- Nepal – full block of Telegram in July 2025

- Kenya – nationwide block on June 25, 2025

Despite the regional blocks, global Telegram activity remained stable.

The State of Advertising in Telegram Mini Apps

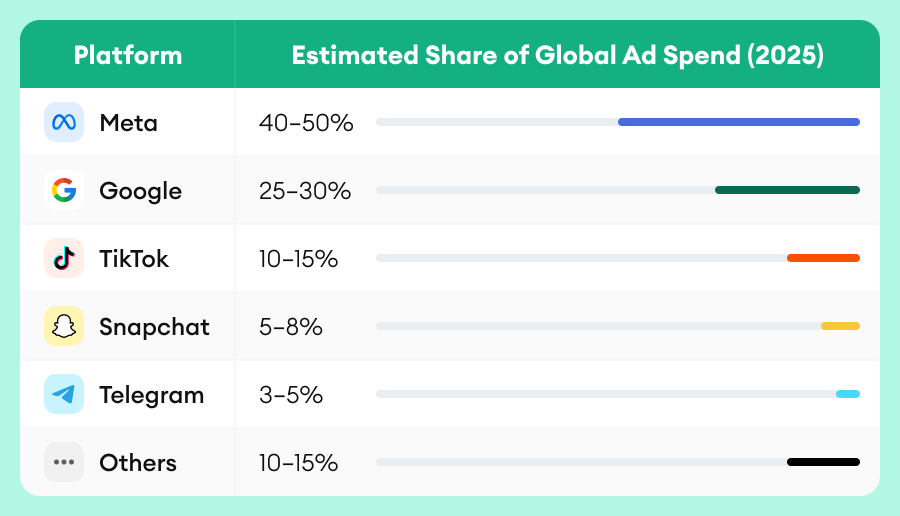

All these ecosystem shifts inevitably reshaped the advertising market inside Telegram and particularly TMAs. Here is the estimated distribution based on industry reports and market observations:

Even surrounded by giants, Telegram holds a stable share in the advertising landscape. This proves that the source delivers high efficiency, flexibility, strong user attention, and way better adaptability to trends than traditional ad placements.

The next section of our report delves into the key statistics on TMA advertising currently.

Сore Market Trends

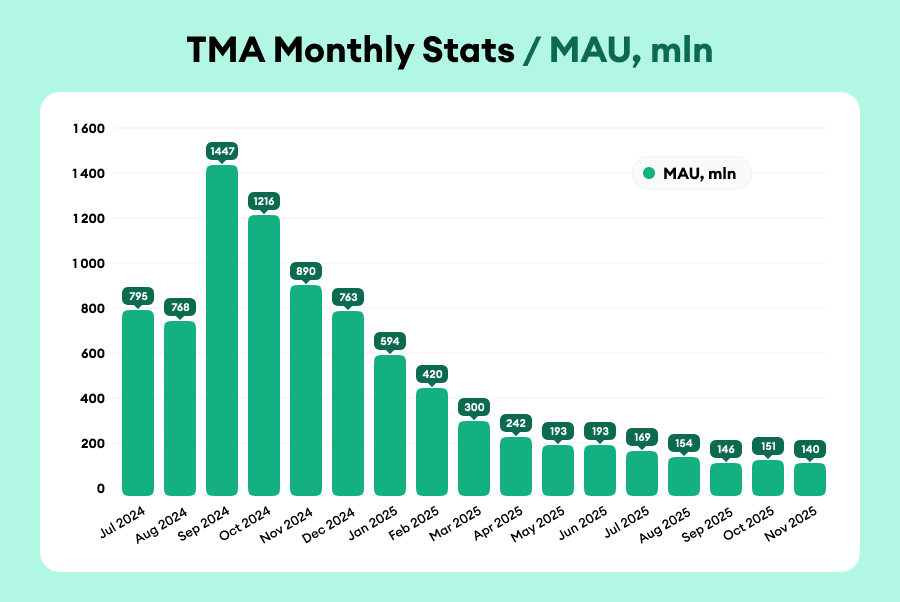

TMA usage went through major swings in 2024-2025. After peaking at 1.44B MAU (monthly active users) in September 2024, activity declined and stabilized at a lower but steady 150–190M range by mid-2025.

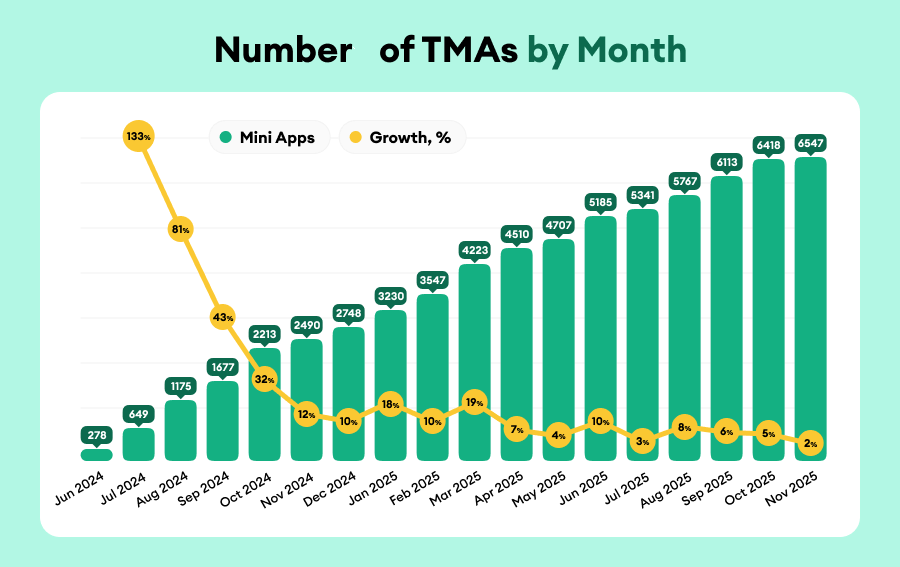

TMA Annual dynamics

The sharp rise and fall of TMA usage was largely driven by tap-to-earn apps like Hamster Kombat, which inflated the ecosystem with reward-seeking users. Once the hype faded, most of these users churned. What remained was a smaller but far more stable audience that uses Mini Apps for practical purposes, and this is why MAU stabilized.

This marks the end of the hype phase and the start of a more mature, predictable usage pattern.

Source: Findminiapp report

At the same time, the number of Mini Apps continues to grow – comparatively slowly, but still consistently at 2-8% each month. This allows us to conclude that while user spikes cooled down a bit, the developer interest didn’t. For advertisers, this is actually positive: the TMA catalog keeps expanding, and new niches like Utilities, Business/Work, or Shopping continue to appear. Mini Apps are entering a growth stage, which is a positive shift for those who prefer relying on long-term results.

Source: Findminiapp report

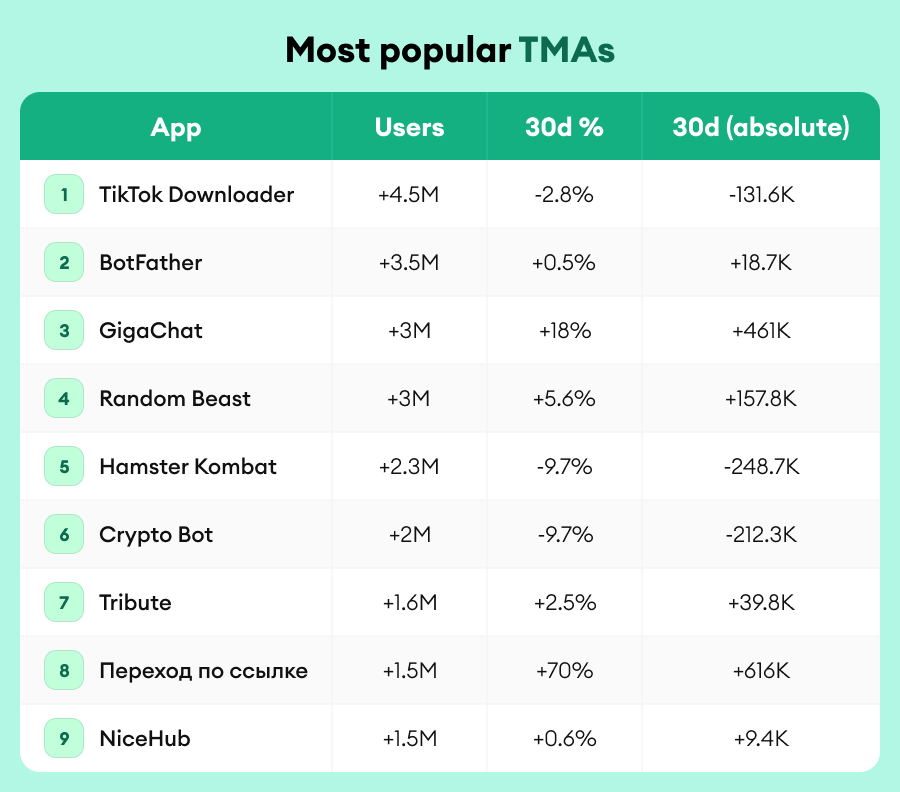

Most popular TMAs

The top TMA ranking shows two groups: apps that lost users after the hype, and apps that keep growing because people actually need them. TikTok Downloader remains the largest app, but continues to drop. Meanwhile, GigaChat, a GPT-like chatbot, demonstrates the strongest performance with +17% growth, which implies an active interest towards AI-based apps.

Gaming leaders like Hamster Kombat and Random Beast keep losing users as the hype wave fades – with the latter showing short-term growth, though.

Overall, this leaderboard again proves that the TMA ecosystem is shifting toward more stable, service-based apps with returning users.

Source: Findminiapp report

Emerging categories

According to FindMini.app, Games, and Crypto/Web3 dominate the TMA landscape. Media/Entertainment, the Telegram Platform, and Tools/Utilities niches are another big tier with steady growth.

Source: Findminiapp report

Tools/Utilities and Business/Work show the strongest growth, but are still mid-sized, so we can name them consistently emerging niches. Meanwhile, Shopping/Services, Communication, Lifestyle, and Education remain smaller categories, but with still positive growth. This again highlights that Telegram’s Mini App ecosystem is expanding beyond gaming and crypto.

Propeller’s fastest-growing TMA verticals mostly match the broader Telegram ecosystem: Games, Social Apps, and Mobile Utilities are expanding both in overall TMA supply and in advertising demand. The only gap is E-commerce and iGaming: they grow strongly inside Propeller’s TMA traffic, while the global TMA ecosystem still has a much smaller presence of these categories.

This clearly showed that the new TMA ad format has been well-accepted by advertisers who work with Popunder and Push Notifications traffic. Besides, it is perfectly integrated into the marketing mix of the iGaming and eCommerce vertical.

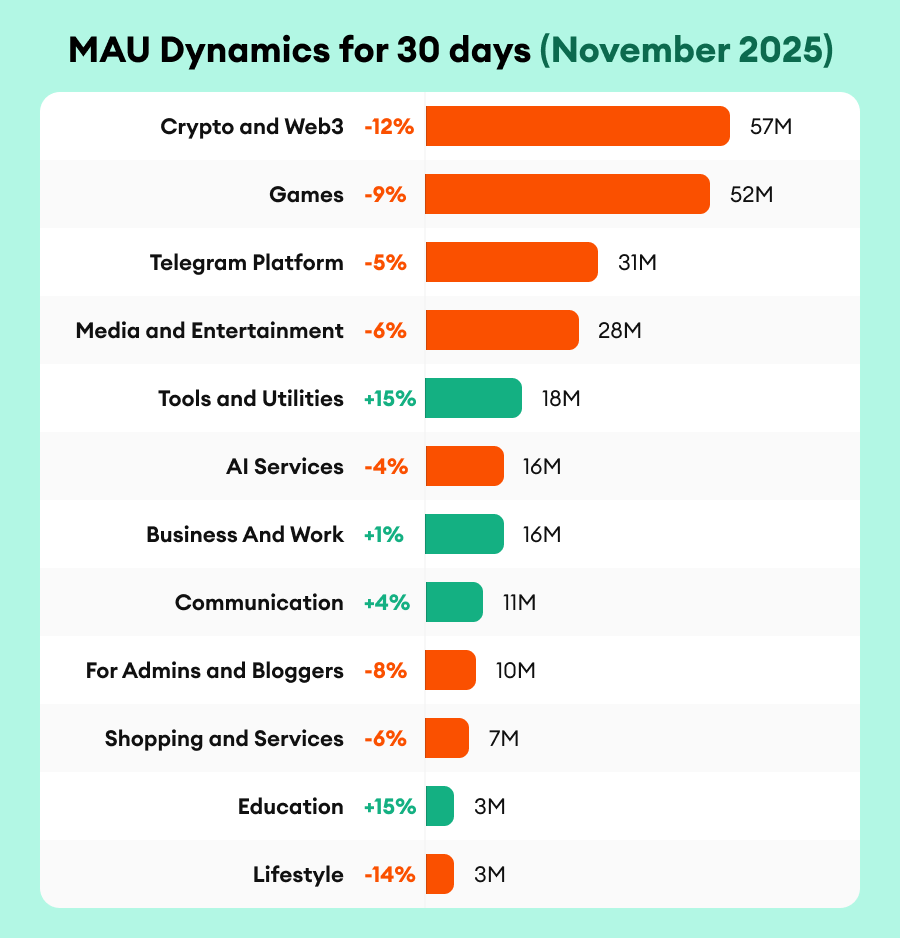

MAU Dynamics

This chart again shows how the ecosystem is stabilizing after the early hype. Here are the overall statistics found at Findmini.app:

Source: Findminiapp report

Crypto and Games, the two biggest segments, continue to dominate by volume: 57M and 52M MAU. However, both are declining (–12% and –9%). The trend is obvious: play-to-earn clones and airdrop farms are evidently losing traction.

Telegram-native categories such as Platform, Media, and AI Services show only slight and likely temporary declines. Meanwhile, practical Utility apps are growing: Tools/Utilities and Education are the fastest-growing segments (both +15%).

Overall, the graph demonstrates that TMAs return to stability and regularity from hype: utilities, communication, tools, education, and AI helpers have replaced the clickers.

PropellerAds traffic mirrors this market shift: as the classic tap-app segment fades and MAU on those placements declines, our advertisers bring in more utility and AI-driven products – not only through pre-load systems, but smart automation and bot-based ecosystems.

TMA Ads & Monetization Trends

Telegram Mini App ads in PropellerAds allow advertisers to reach real active users directly inside Telegram Mini Apps. Ads inside Telegram channels have a caveat: part of the audience may be passive or even bot-inflated. Meanwhile, TMA ads work inside mini apps with action-driven mechanics, which naturally filter out fake traffic. In simple words, only users who genuinely interact with the app see the ads.

How Do TMA Ads Work?

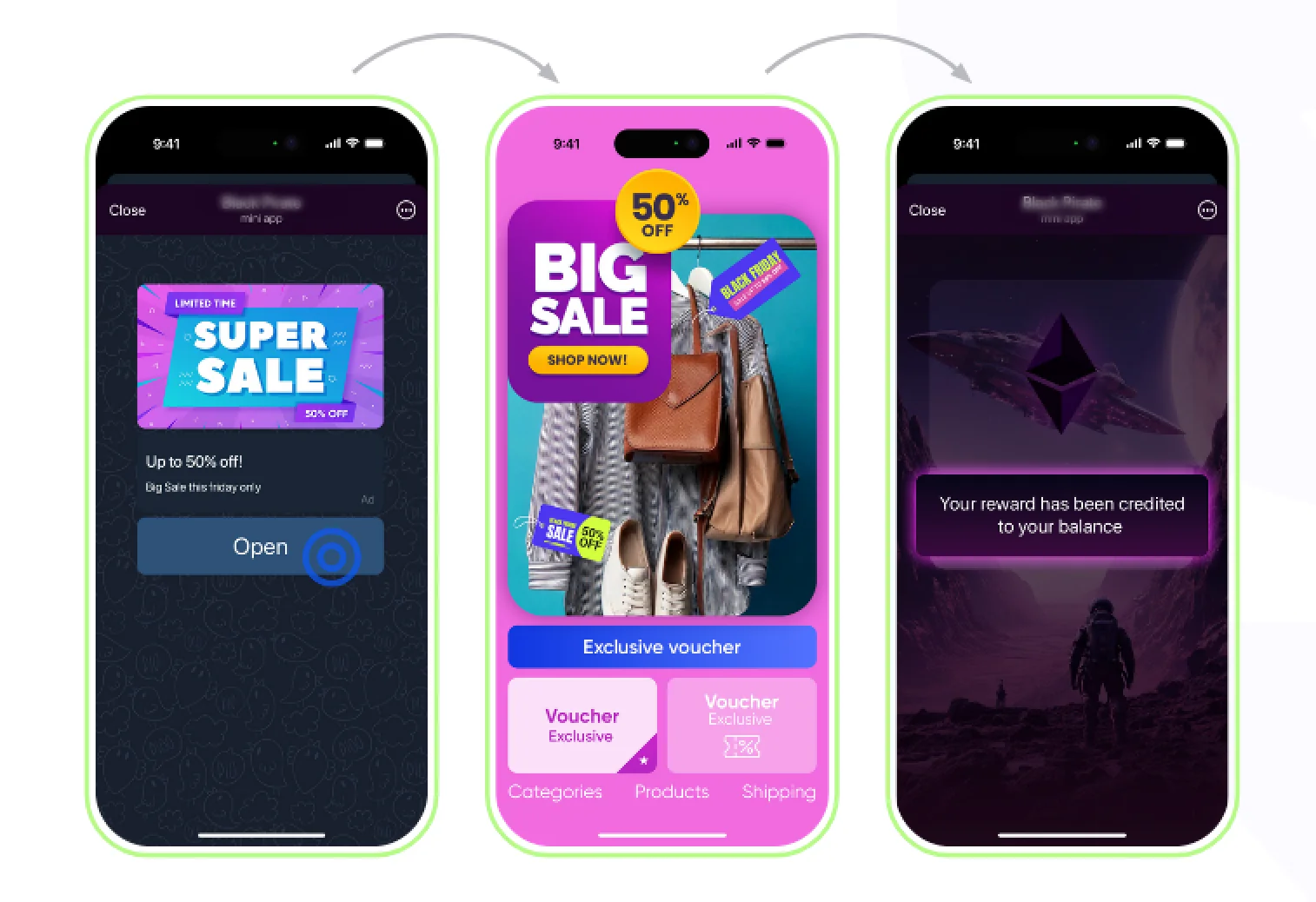

With PropellerAds, brands can run the two main ad formats inside Telegram Mini Apps:

- Rewarded ads. This ad type appears when a user taps an in-app element that unlocks an in-game reward. After watching an ad, users receive a reward, such as coins, hints, bonuses, or extra attempts. The main advantage of this format is that a user interacts with an ad totally voluntarily, so it does not ruin UX in any way.

- Non-rewarded ads. This format is displayed at natural pauses, such as between screens, after a timer, or during level transitions. They don’t offer rewards and don’t require user consent, unlike rewarded ads, so they monetize the user flow more passively, similar to standard mobile apps.

Both options are flexible: they allow advertisers to promote Telegram products (1.3% of campaigns) or drive Telegram users to external platforms (98.7% of campaigns).

Since TMA ads run inside the Telegram platform itself, advertisers can target* users using options unavailable in channel advertising:

- Users with TON wallets: people who activated a wallet or made on-chain actions; a high-value segment for crypto, fintech, utilities, and games.

- Telegram Premium users: an audience with premium Telegram accounts who don’t see Telegram Ads, and thus remain more engaged. What is more, these users have a higher purchasing power.

- Fresh/low-ad-exposure users (UVC targeting): people who have seen very few ads inside Mini Apps. This targeting option ensures impressions from users with lower ad fatigue.

Now, let’s take a look at the core statistics that define how TMA advertising performs today.

* Please note that certain targeting options are only available for managed clients.

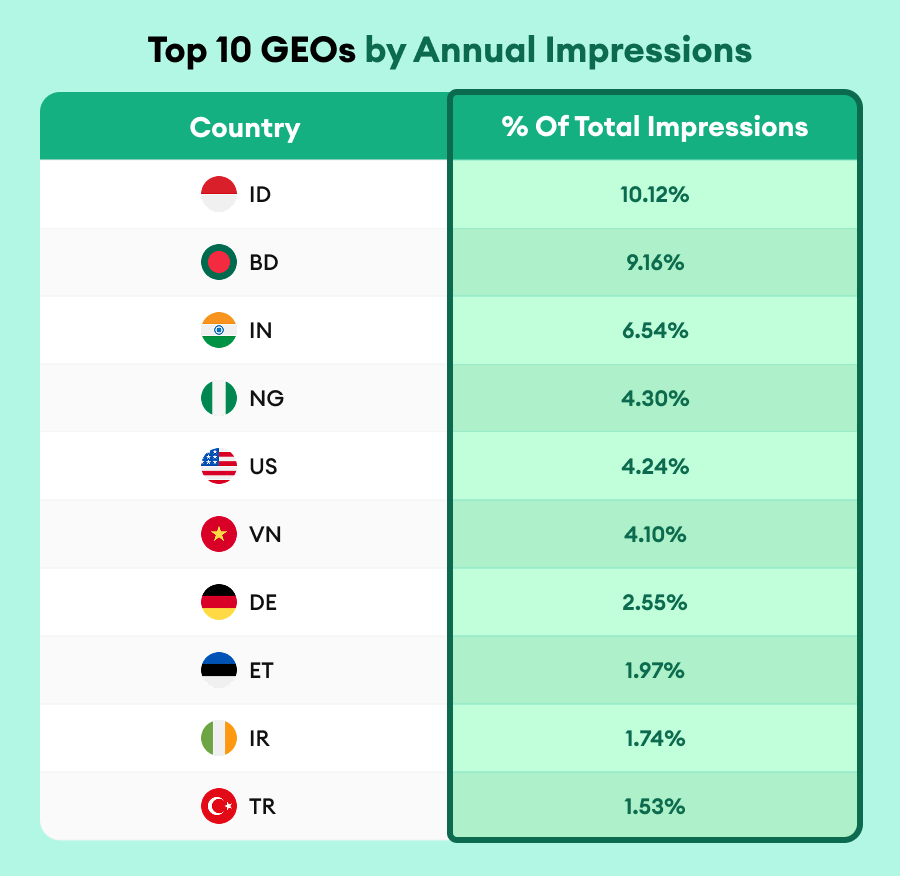

Top 10 GEOs by Annual Impressions

The strongest TMA ad volumes come from markets like Indonesia, Bangladesh, India, Nigeria, and Vietnam. These GEOs generate the highest impression rates. Tier-1 markets such as the US and Germany drive smaller but more valuable traffic.

Overall, we see a classical traffic split here: emerging GEOs bring in scale, Tier-1 countries drive premium users.

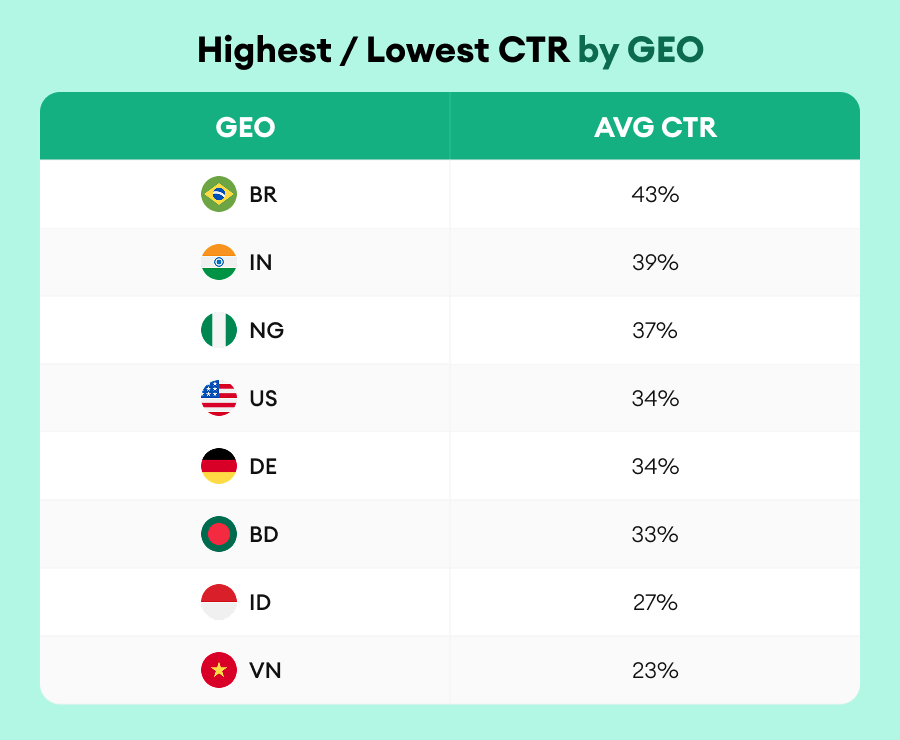

Highest / Lowest CTR by GEO

A look at the click-through rate makes it clear that users do click TMA ads, and not just occasionally. The consistently high CTR across GEOs (20–40% on average) shows that TMA ad formats do not just run in the background, but people actively interact with them.

CPC by GEO

This table clearly highlights the CPC gap between Tier-1 and emerging GEOs when using UVC targeting. Most Tier-2/3 markets (India, Vietnam, Bangladesh, Indonesia, and Nigeria) deliver cheap traffic at ~$0.01 CPC, while the US and Germany are significantly more expensive due to higher competition, with Brazil in the middle.

Read more: Telegram Ads CPM and CPC Rates Explained

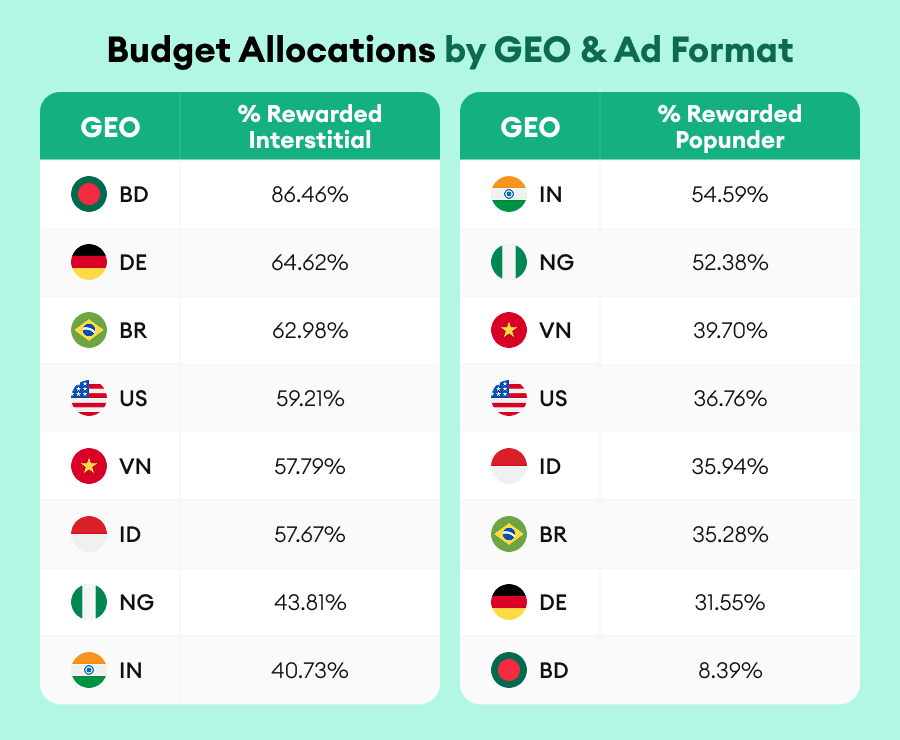

Budget Allocations by GEO & Ad Format

The statistics show that Rewarded Interstitials dominate, while Rewarded Popups make up the smaller but highly engaged portion.

This share of rewarded formats is stable across GEOs:

- Rewarded Interstitial: ~60–70%

- Rewarded Popup: ~30–40%

Together, these two formats create a balanced setup: one drives bigger volumes, and the other one boosts engagement.

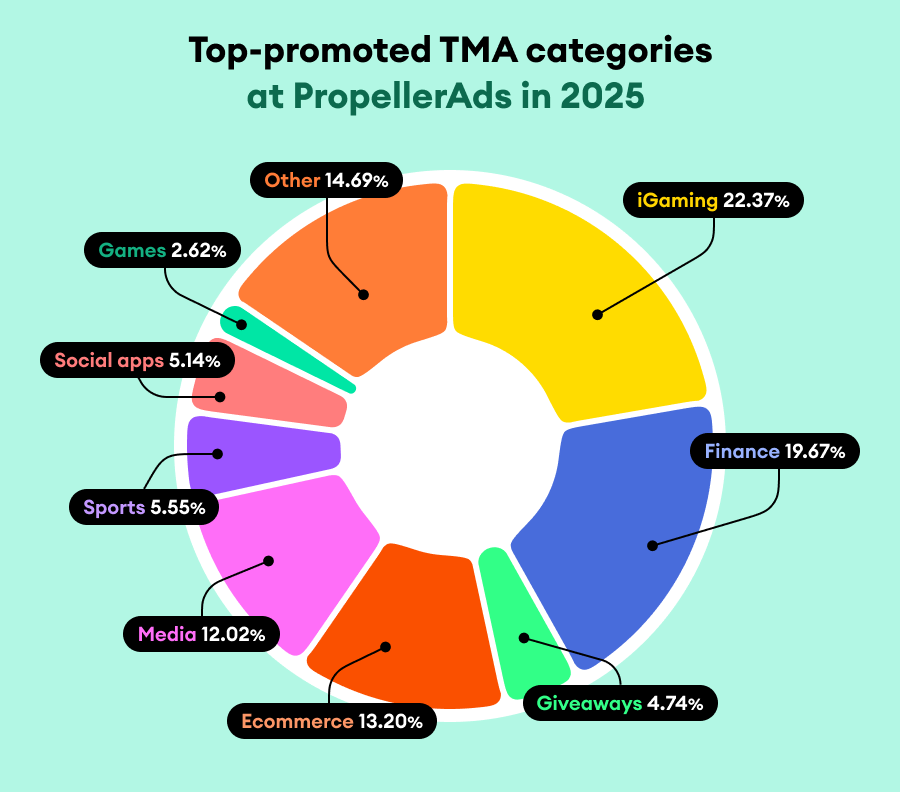

Top-promoted TMA categories at PropellerAds in 2025

iGaming takes the largest share of TMA impressions (22.37%), showing strong advertiser demand and high bids. Finance follows closely with 19.67%, while E-commerce (13.20%) and Media (12.02%) can be grouped into a larger category with lots of volume, strong CTR, and broad targeting. Sports, Social Apps, Giveaways, and Games stay stable but not dominant.

Fraudulent Traffic Prevention

Telegram’s rapid growth has also made it a magnet for increasingly sophisticated fraud schemes. Scammers exploit the platform’s openness, anonymity, and high advertiser demand – creating risks not just for users, but also for brands. Below are the four most common fraud patterns every advertiser should recognize and be ready to counter:

- Fake channel administrators selling ads. Scammers clone a channel owner’s username, avatar, and bio, show photoshopped screenshots of previous placements, take crypto prepayment, and disappear. Sometimes, they revive old, already dead channels to look legitimate.

- Contest + investment sponsor scheme. Fraudsters run legit-looking giveaways to grow a channel via Telegram Ads. Then they push users to follow a fake investment expert who collects deposits and vanishes.

- Fake service/payment bots. Telegram bots mimic utilities, government services, delivery apps, or major brands. Users enter real payment data, which goes straight to scammers. These bots are often promoted through channel ads.

- Channels with bot subscribers and fake activity. Another common scheme is when channels artificially inflate their subscriber count and impression numbers using cheap bot farms. A channel looks big, active, and expensive, but the real reach is close to zero. When an advertiser purchases an ad space on such a channel, there are two possible scenarios:

- They send bot traffic to imitate clicks or joins,

- An advertiser gets no real audience at all, because the channel’s MAU is fake from the start.

And fraud continues to evolve. Recently, ADEX uncovered a Telegram-focused phishing scheme disguised as mobile subscription offers. Fraudsters tricked users into entering real Telegram login codes in a subscription form and hijacked their accounts.

Such a fraud scheme can affect not only direct channel buys but can also appear in Telegram Ads, since ads are displayed inside channels, and some of those channels are bot-inflated too. Meanwhile, the aforementioned issues are almost not related to advertising inside Mini Apps.

Vladislav Pomogaev, Swift Agency: There is significantly less fraud inside Mini Apps. It is simply much harder to fake real in-app behavior than to inflate a Telegram channel with bots (I am speaking as someone who helped build 10+ mini apps). On top of that, ad networks keep strengthening their anti-fraud systems, which makes the ecosystem cleaner. As a result, TMA traffic is generally higher-quality than many traditional Telegram ad formats.

While fraud remains a risk, the broader Telegram ecosystem is evolving rapidly – and not only in terms of security. As the platform matures, new advertising behaviors, formats, and user patterns are reshaping how brands approach Mini App ads. These emerging trends set the stage for what advertisers should expect in 2025.

Trends 2026: Where is the Market Heading?

The number of Mini Apps keeps growing every month, and that’s the biggest signal to watch. The more apps appear, the more traffic sources advertisers get access to. According to Vladislav, there are two possible scenarios ahead for 2026:

- Mini App audiences continue to grow. In this case, TMAs will have more traffic to sell, and the overall market economics will continue to improve.

- Some GEOs may introduce new restrictions on Telegram. If such limitations intensify in 2026 and the available traffic drops, Mini App advertising in certain countries could become less profitable but potentially cheaper as well.

Vladislav also mentions that, since October 2024, following the major mini-app hype, user activity began to decline, and this decline lasted for approximately 10 months. However, the recent months have shown a calm, steady growth in the number of active users. This suggests that the market has transitioned from the tap-to-earn spike into a stable development phase, and we can expect more new and innovative projects to emerge.

A similar perspective is shared by Svetlana Prishchak, the Head of the Telegram project:

By 2026, the Telegram Mini Apps and bots ecosystem will move beyond experimentation and form stable product niches. While overall audience growth may slow down, product quality, usage scenarios, and monetization models are clearly evolving. Mini Apps and bots are becoming more complex, more useful, and more deeply embedded in everyday user behavior, which directly impacts engagement, retention, and LTV. For advertisers and investors, this means a shift toward more predictable and sustainable monetization models built around mature products and high-quality audiences.

This shift is also visible from the developer side. As the Vibes Agency CEO notes:

We specialize in premium Telegram Mini App development for banks and business communities, and what we see globally is that the market is still at a very early stage. While over 60% of current Mini Apps are crypto-related projects coming from regions like North and Latin America, the share of functional, utility-driven products worldwide is still relatively small.

In the CIS, this means we’re essentially working with a clean slate: there aren’t many established standards or saturated niches yet, and high-value audiences are only starting to explore Mini Apps. We believe this early phase offers opportunities for teams to build high-quality products and shape best practices, especially for business and premium segments. Adoption will take time, but the direction is promising, and we expect Mini Apps to evolve into a consistent, high-value touchpoint for brands and communities.

Together, both perspectives suggest that the Mini App ecosystem is entering a formative period: not explosive, but foundational, with long-term potential.

Conclusion

The TMA market has moved from hype to stability. User activity is no longer explosive, but mini apps continue to grow in number, and new utility-driven niches are emerging. CTRs remain high, fraud is lower than in classic Telegram ads, and advertisers now get more predictable results across GEOs.

PropellerAds gives brands direct access to real, engaged TMA users through high CTR ad formats with advanced targeting options – all with cleaner, fraud-resistant traffic than traditional Telegram ads.

If you want to test or scale Telegram Mini App advertising –